Monday, September 29, 2008

Higher Construction Costs means Property Price must rise ?

There's this Ad in Straits Times (13 Sept 2008) on Livia Condominium for Sale:"With land costing easily between $250 & $350 psf coupled with high, construction costs, developers' break-even cost is at least $700psf. Livia's average price of $650psf is definitely a steal" Jack Chua, President, ERA; Peter Ow, Executive Director, Knight Frank

Implicit in this sort of sale pitch is that with the soaring construction costs, property price must inevitably rise. To this, we've the responses of property sellers and buyers in the Singapore Property Forum:

Seller:

"yes it is absolutely true that land price, construction costs, labour costs, etc have all gone up which means developers will not be able to sell at less than their cost, that will be plain stupid and not in the interest of shareholders. knowing that demand now is weak, deveopers will not launch aggressively as they are not stupid."

Buyer:

"it is plain stupid to be stuck with a big stack of hot potatoes and paying interests and affecting cashflow which is definitely not in the interest of the shareholders. They are not stupid, but they miscalculated.

How many people stuck with hot potatoes are stupid? They are just greedy and miscalculated."

Another Buyer:

"since when are developers so generous to sell cheap just because land and construction are cheap?... in 1996 (property peak) construction cost is definitely cheaper than today but price was high until people go bankrupt ... developers will sell high high if buyers are suckers enough to pay high high price... if nobody is willing to pay or just cannot find bank loan to pay for high high price, then nobody buys ... then developers will have to sell at price people can pay or willing to pay .. so dont keep on talking about construction cost going up ... only stupid people believe you "

Seller:

"so be careful when you read about comments by bearish people. just think about it, if they are so bearish they would have sold their own homes and renting now. do they do that? NO. these people already own their own property and want to buy a second property and hence they go around shouting for prices to go down. they use the US credit crisis as reasons for prices to go down."

Buyer:

"There is no point in selling and renting now as we are not property speculators. We do not shout for prices to drop and to buy cheap. It is to tell people not to be SUCKERED to buy expensive as what you wanted them to do."

Seller:

"so if you own a home and can afford your mortgage there is no need to be afraid. as long as you are not overleveraged and live within your means, you should do ok."

Buyer:

"Unfortunately a lot of people are over-leveraged and greedy. For these people, what advice do you have? Isn't it the same advice as bears? Be prudent, don't over-leverage or just sell if you have a chance?....If you have made a mistake and then you try to cover it up (by being in self-denial or telling others that market will continue to go up) you have made another mistake."

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

Livia Condominium @ Pasir Ris 160 units sold during Launch

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

7

comments

![]()

Saturday, September 27, 2008

Singapore Property Buyers increasingly attracted to Overseas Property Investments

According to the Asia Property Trends Survey 2008 from iProperty, there is a decrease in the number of property investors buying in Singapore with only 54% said they would purchase a property from the Singapore private property market. This is a significant fall from 2007 when 78% of Singapore property investors chose Singapore property as their prime interest. This indicates that overseas property investments are becoming increasingly more attractive to Singapore property investors. The geograhical shift in real estate interest should not come as surprise as property price remained all time high in Singapore, while property prices in many parts of the world have declined.(The Global Property Guide, a property research group, reported that for the first half of year 2008, property prices fell in 21 of the 33 countries.)May also want to read:

Property Buying Tips: Lessons from Boom-Bust Property Cycles of the World

History of Singapore Property 1960 to 2008

HDB Resale flats Price Index 1990-2008: Graph & Chart

Property Price Index Graph Plotter & Online Property Valuation

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Labels: 0.5 Property News Analysis Sept 2008, 3. Private Property Outlook

Property Buying Advice: Lesson from Boom-Bust Property Cycles of the World

While Singapore property buyers are wondering why property prices in Singapore haven't fallen yet, property prices have already been falling all over the world. The Global Property Guide, a property research group, reported that for the first half of year 2008, property prices fell in 21 of the 33 countries. We have been getting similar gloomy news about the China property market too.Business Times - 25 Sep 2008 on the meltdown of the China property market:

"After months of steely resistance, Chinese property developers have finally thrown in the towel and slashed prices as sales fall. Whether the move succeeds in putting a floor under the market will help determine the fate of the economy over the coming year, especially because China needs to spur domestic demand to counter weakening exports as the global credit crunch intensifies."

On the "steely resistance" put up by developers in the initial stage of the property downturn, forumers at the Singapore Property Forum have these views to share with property buyers still waiting on the sideline:

ann:

"This pattern is observed in many countries. Price booms, but after market changes, bust is delayed whilst sellers remain in denial or act tough. All the while, sales volumes are threadbare. Finally, they give up and lower prices. Same thing here in Singapore. Thankfully, most buyers/upgraders/investors can wait. They can wait indefinitely. All the while, the supply glut /TOPs grows closer and closer. Why buy now when you can buy later for less? China carried a myth that prices could not fall because of rapid growth, Olympics etc. What myths do we carry? Yes, IR, F1, YOG etc. "

aitan:

"Agreed with you, Ann. Your boom to bust cycle pattern is part and parcel of this game. Only problem is our bulls in this forum thread refuse to understand the rule of the game and are trying their very best to hold the market, as if they can, by shouting and screaming at all the bears. They refused to admit that our mythology of F1, IRs, YOG and Global City presentation had already been factored in during the last Bull run that ended last year. Hope when they finally realize the rule of the game, they can survive with enough seed money to play the next bust to boom game. "

anonymous:

"Agree with both of you.

The longer the bulls wait, the louder the crash. Because when they finally realise that nobody is buying all those hypes of F1, IRs, YOG and Global City; it'll be too late. They'll find themselves having to live with the reality of the economic downturn - low rental yield if they're lucky to find a tenant at all, higher mortgage rate and some will face downright problem with even securing a bank loan, lower bonuses or even pay freeze if not retrenchment ... by which time most buyers have already vanished !!!

The long term outlook of Singapore is not as rosy as all the media would like us believe. Both US presidential candidates have vowed to bring back jobs to America. It's going to be a world threatened by protectionism. That can spell doom for an exporter like Singapore. China and India are getting most of the foreign capital inflow with the attraction of their huge domestic market. So how do we compete ? Until we figure out a workable strategy, at the very least, we'll have to become cheaper or be squeezed out of the global market."

May also want to read:

History of Singapore Property 1960 to 2008

HDB Resale flats Price Index 1990-2008: Graph & Chart

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Singapore's Manufacturing Output for Aug 2008 Fell 12.2%

Singapore's manufacturing output in August 2008 fell more than expected , slipping 12.2 % year-on-year, more than the 8%-9% forecasted by economists.The worst performer was biomedical sector which contracted by 33.8%. The best performer was the transport engineering sector, which saw positive growth of 6.1%, mainly attributed to the aerospace segment. But economists say this is unlikely to prop up the rest of the flagging manufacturing sector.

Global consumption is expected to slow due to the economic downturn, and Singapore's export-driven manufacturing sector is likely to contract as the world tightens its belt. Observers also expressed concern over what the results for September would be when the full impact of the recent Wall Street meltdown is felt.

In a report on 21 Sep 2008, DBS Group Research says it expects a technical recession, and downgraded Singapore's full year economic growth outlook to 3.6%-4.2%.

Singapore's economy contracted by 6% in the Q2 2008 from Q1 2008. A contraction in the Q3 2008 will mean a technical recession.

According to economists, Singapore will probably slip into a recession in Q3 2008 for the first time since 2002 after exports and manufacturing slumped and fewer tourists visited the city state, economists said.

May also want to read:

History of Singapore Property 1960 to 2008

HDB Resale flats Price Index 1990-2008: Graph & Chart

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Thursday, September 25, 2008

99 Leasehold Property: Calculation of Depreciation Rate based on Singapore Land Authority Data

The table below published by SLA (Singapore Land Authority) shows the value of a 99-leasehold property as a percentage of a freehold property as the number of years left in the lease (Labelled as "Term of Years" in the table) of the 99-leasehold property. This is based on the Development Charge (DC) that SLA will impose for extension of 99-leasehold land. For example, we can see from the table that a 99-leasehold is valued at 96% of a freehold property when it is brand new, i.e., the "Term of Years" is 99. By the time the "Term of Years" is 20 years, the percentage value of a 99-leasehold property is reduced to 48% of that of a freehold property.

The table below shows a simple example of a freehold property valued at $1M throughout the 99 years in consideration for which a 99-LH property will be valued against based on SLA's table given above. In this example therefore a 99-LH property will be valued at $960K at the beginning of its 99 year lease (ie. 96% of $1M) and $946K after 9 years when it is left with 90 years lease (i.e. 94.6% of $1M). The rate of depreciation is then calculated by taking the difference between the current value of the 99-leasehold property and that of the preceding year as a percentage. For example, the rate of depreciation for the first 9 years is ($946K-$960K)/$946 = -1.5%

(The example above looks at the depreciation of a 99-LH property solely from its lease reduction. It does not take into account other factors such as the "age depreciation" of the property which all types of properties will suffer.)

The above analysis shows that the rate of depreciation of a 99-LH property would have accelerated from an average of 1.5% for every 10 years in the first 19 years to more than 20% towards the last twenty years of the lease.

In reality, the rate of depreciation will likely be worse than that projected here as a result of advanced market discount for the uncertainty in 99-year leasehold property in terms of lease-renewal cost or if at all renewable, availability of mortgage and limits in CPF usage. A study of URA transaction records will reveal that capital gains are likely only for relatively new leasehold properties purchased during the property bust cycle or in a rapdily rising market as in 2006-2007 and held for short period. Because timing the market is difficult, as all seasoned investors know, such capital gains are in reality hard to come by within the short market life-span of a 99-year leasehold property.

Market perception makes market reality. For those buyers who think that 99 years is a long way to go, substantial depreciation is likely to set in even in the near term because of market perception. So buyers should seriously consider the odds against 99-LH properties especially at a time like now when they are still priced at sky-high level.

May also want to read:

Singapore Government said 99-year Lease Top Up cannot be taken for granted

History of Singapore Property 1960 to 2008

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

Posted by

Smart Buyer

3

comments

![]()

Tuesday, September 23, 2008

Private Property Market Increasingly Vulnerable to Downturn, say analysts

Private residential property prices may still be holding for now but analysts say the market is increasingly vulnerable to a sudden downturn.Singapore Private Residential Property is Fully Priced

Global property investor LaSalle Investment Management, which has $6 billion of real estate assets in Asia, says Singapore residential property is "fully priced".

Singapore Luxury Residential Property are Expensive by global standards

Jack Chandler, LaSalle Investment Asia-Pacific Chief Executive Officer, said that by global standards, Singapore luxury apartments are very expensive and that at some point, affordability and common sense have to come in. Singapore property price increase has already surpassed those of regional rivals such as Hong Kong.

Sharp Decline in Private Property Sales

Property developers and agents say fewer deals were struck last month. Official data from URA shows that number of sales for private property has declined by more than 80% in August 2008 year-on-year.

Property Investors are getting nervous

"I'm nervous because I don't expect prices to rise anytime soon. The signals aren't good," said Charles Wong, who paid more than $1M for a one-bedroom downtown apartment in April 2008.

Excess Supply of Private Property by 2009

"In terms of actual occupants, there will be excess supply by 2009," said Jones Lang LaSalle Head of Research Chua Yang Liang. He estimates the number of private property units that will be completed in 2009 to be nearly four times that expected this year.

Foreign Investors More Selective, Focus Increasingly on High-End Properties

At least four out of five Singaporeans live in state-subsidised high-rise flats, leaving the private home market dependent on upper-income residents and foreigners. Investment firm Emirates Tarian Capital is betting these foreign investors, who comprise nearly half the buyers in most projects, will focus increasingly on high-end homes. "Demand is going to be selective and for branded, quality projects where the quantity is limited," said Kunalan Sivapuniam, managing partner of the firm, which is investing in two high-rises including one 30-storey block equipped with individual lifts to bring owners' cars up to each apartment.

Credit Crunch May Constrain Developers' Ability to Offer Deferred Payments

Analysts say a global credit crunch could constrain Singapore developers' ability to offer Deferred Payment Scheme (DPS) that allow buyers to make a 10%-20% deposit and delay the bulk of payment until the TOP of the property. Up to 90% of buyers for some projects opted for DPS during the recent property boom.

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Labels: 0.5 Property News Analysis Sept 2008, 3. Private Property Outlook

HDB BTO Flats see Strong Demand

THE strong demand in the HDB market saw bookings of HDB's Build-To-Order (BTO) flats increase by 49%, and the number of unsold HDB flats reduce from 3500 to 1500. HDB will offer 8400 new Build-To-Order (BTO) flats in 2008, compared to the 6000 in 2007 and 2400 in 2006. Of the 8400 HDB flats slated for 2008, about 5000 have already been launched.‘There has been an increase in demand for new flats,’ HDB chief executive Tay Kim Poh said at a press briefing on the board’s annual report. ‘We have been ramping up the building programme.’ Mr Tay also said that HDB will adjust supply for 2009 accordingly to meet demand. In the light of rising construction costs, he reaffirmed HDB’s commitment to keep HDB flats affordable. According to HDB, a 4-room flat can cost about $300,000 to develop today, taking into account land, building and other costs. This is higher than the subsidised price of a 4-room flat sold by HDB at $200K to $260K.

To ensure that the basic housing needs of people are met, PropNex’s Mr Ismail said that HDBs may have to review certain policies, such as the income ceiling for HDB flat applicants, and perhaps even abolishing the resale levy.’

May also want to read:

History of Singapore Property 1960 to 2008

HDB Resale flats Price Index 1990-2008: Graph & Chart

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

5

comments

![]()

Labels: 0.5 Property News Analysis Sept 2008, 4. HDB Market Outlook

Monday, September 22, 2008

Singapore Government: Recession not rule out as Singapore exports fall

A decline in Singapore's August exports, the fourth straight month of decline, has raised the risk of a technical third-quarter recession.Just in June 2008, Tharman Shanmugaratnam, Singapore Finance Minister, has said that Singapore is not heading for a recession in 2008. But the continued decline in exports has now raised concern about a possible recession. In an e-mailed response to an Associated Press inquiry, Tharman said that a recession "cannot be ruled out".

Singapore's Trade Minister Lim Hng Kiang was quoted as saying the economy may grow below the government's forecast of 4%-5% this year as the global credit crisis hurts demand for exports.

May also want to read:

History of Singapore Property 1960 to 2008

HDB Resale flats Price Index 1990-2008: Graph & Chart

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Singapore Economic Growth Forecast for 2008 as low as 2.8%

A recent poll conducted by The Straits Times of private sector economists shows that Singapore economic growth will likely come in under 4%, with some downgrading their forecast to as low as 2.8%.The official forecast for Singapore economic growth is still a 4%-5%, but Trade and Industry Minister Lim Hng Kiang has already said full-year growth may dip below the forecast.

PRIVATE sector economists are turning increasingly bearish on Singapore’s economic outlook in 2008 with the weaker-than-expected performance in exports and tourism, which is likely to be further aggravated by the recent Wall Street meltdown.

Citigroup economist Kit Wei Zheng has cut the Singapore economic growth forecast for 2008 to 2.8% and for 2009 to 2.5% , as ‘ripples from the credit crunch hit home’ and trigger a longer and deeper downturn that had been expected earlier this year.

Barclays' Mr Leong Wai Ho is banking on a ’significant pharma-led bounce’ Q4 2008 to materialise a just over 4% growth, the highest forecasted growth among those polled.

DBS Bank economist Irvin Seah said that the latest round of upheaval in the financial markets, triggered by Lehman Brothers’ collapse last week, has sharply increased the risks for Singapore economy.

Exports fell in Aug 2008 by the most in 20 months, plunging ~14% year-on-year and the fourth straight month of decline. Tourist arrivals also dropped for the third consecutive month in Aug 2008 hit by the global economic slowdown. These figures have made economists increasingly convinced of the possibility of a technical recession in the third quarter, defined as two consecutive quarters of negative growth.

What the final number hinges on is the highly unpredictable pharmaceutical industry, which could still swing things either way in the last quarter, said economists. Always a wild card, this sector - which accounts for about 6% of gross domestic product - has now become pivotal, especially since they cannot put a figure to it.

May also want to read:

History of Singapore Property 1960 to 2008

HDB Resale flats Price Index 1990-2008: Graph & Chart

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Saturday, September 20, 2008

Mortgage Advice: Is it good to stretch home loan for a longer period to increase leveraging?

Question from a blog visitor:Would like to seek your views regarding mortgage loans. Generally is it usually a good idea to stretch a home loan as long as possible?

Recently i was also offered a 3-month sibor package where the monthly installments are fixed, but the principal paid varies with the interest rate.

I think it sounds like a good package as there is some certainty in the amt of monthly installments paid, but any potential pitfalls from this? And the equity accumulation is quite slow due to the length of loan.

Reply by Mortgage Consultant, Mr Paul Ho:

To answer your first question. It is important to understand whether you treat the property as a single home or investment property. Different people may react differently as it is an emotional decision. For some it is an affordability issue, therefore stretching the home loan will allow you to stretch your budget to buy the home of your dreams.

Financially speaking if you are staying in the home, stretching the home loan incurs higher total cost. But some investors have been known to stretch the home loan for as long as possible to maximize their return on invested capital (If this is your concern, I can elaborate more). Longer term loans tend to be costly because all loans are structured in such a way that mostly interests are paid during the earlier years. So you will see that your outstanding loan amount seems to be standing still. Instead of 30 years, some people may take a loan of 20 years and at the end of every 2 years, they take another 20 years loan, to speed up repayment of the principle and reduce overall interest cost.

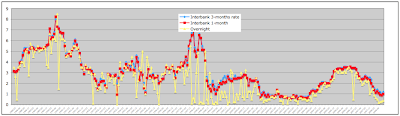

3-Months Sibor with Fixed repayment structured so that the interests are variable and re-priced every 3 months, but you have some peace of mind such that you don't have to worry about how much to pay. Over a 20 year period, interbank rates (Sibor) Singapore dollar Sibor has ever reached about 9% in around 1990. If you are paying Sibor + 0.9%, that would mean you are paying almost 10% interests. Fed overnight rates has gone as high as 20% during the recent financial crisis in which banks stop lending to each other or tightened drastically. So markets such as the Libor (London), Sibor (Singapore) are technically not immune to fluctuations in the market. And as a rule of thumb, a 3-months Sibor fluctuates more than a 6-months Sibor

Pitfalls of Home Loans with No Lock-in Period: Interest Rates Shocks

There are of course potential pitfalls such as lock-in periods. If no lock-in period is concerned, then you are largely open to interest rates shocks (if any). Though Singapore market is generally flushed with liquidity and hence there tends to be a correlation between low GDP and low interest rates, but that cannot be taken for granted.

Where is Interest Rates headed?

There is likelihood that interest rates may stay low (same as 2002 to 2005), but this time, there is some marked differences, the M1 money supply is much higher. There is also some risks that US bail-out of private enterprises and banks to the tune of almost 1 trillion (1000 Billion USD), plus US deficit of over 500 Billion, the USA cannot afford to find that money. If they expand money supply (aka print more money) there may be elevated inflation risks and therefore interest rate hikes possibilities. Right now, it's anybody's guess.

May also want to read:

History of Singapore Property 1960 to 2008

Property Investment is best long term investment?

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Labels: 5. Mortgage Rate : Home Loans

Friday, September 19, 2008

Property Investment is Best Long Term Investment?

The following is a forum exchange on property investment as the best long term investment:"Nowadays not many investment options. FD - rates too low Stocks - going down all the way. Money market and structured product - can you trust them? Commodities - going down because hedge funds are selling. So property is best - noone can short your physical property, can collect rent and price stable and slowly going up Spore's property is best long term investment."

"Buying property NOW is the fastest way to commit suicide."

"you are out of touch...dont buy expensive new properties. look for cheap RESALE properties and buy only if you can afford it... shares and structured products - suicide if you are not financially intelligent"

"Wrong! New property price go down, resale property also go down. Just wait for the Great Singapore Sale. Cheap old private properties will get even cheaper. Right! Stay away from financial and structured stocks. Also stay away from property stocks. Wait for another fear-grip day like yesterday to buy stocks. Fact: Good stocks always go up within 5 yrs and always go up faster than property price.

Diversify. Don't always property, property.. Singapore private property makes lousy investment .. most are 99LH consumption good, not investment... Keep your HDB flat for long term property investment is a wiser and lower risk choice. "

Extracted from the Singapore Property Forum

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

9

comments

![]()

Labels: 9. Investing-Buying Property Advice, 9.9 Singapore Property Crash Trends - sept

Subprime Effect: Rent to Fall as Financial Turmoil worsens

My Paper reported today that the ongoing global financial turmoil is likely to take a toll on the rents for both commercial and residential properties in Singapore, according to property analysts.Property analysts are yet to assess the impact of the financial turmoil. If the financial turmoil takes a toll on the employment market causing people to lose their jobs and at the same time, foreign senior executives to have to pack for home; then both the Singapore commercial and residential property markets will be impacted.

The first to feel the brunt will be the rental market, said DTZ Tie Leung. ....

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Labels: 0.5 Property News Analysis Sept 2008, 2. Rental Market Outlook

Treelodge@punggol, first HDB econ-precinct, is 90% taken-up

Treelodge@punggol, the first HDB econ-precinct in Singapore, are 90% taken-up. The 3 to 5 room HDB flats in the precint are sold for $139K - $383K. Treelodge@punggol will be completed in 2011.May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Labels: 0.5 Property News Analysis Sept 2008, 4. HDB Market Outlook

Thursday, September 18, 2008

Stock Market Crash: BE GREEDY WHEN OTHERS ARE FEARFUL.

"ST Index 2,341.40 -77.89 Volume 140.7 M Gainers/Losers 32 / 245 SGX 5.850 -0.100. Not looking good ..... "The following forum exchanges on property investment vs buying stocks in the light of the stock market crash today is extracted from the Singapore Property Market:

"smart investors are now buying property as property price is more stable and likely to rise ..now they are collecting rentals and not afraid their property will be SHORTED cos share you can short but physical property you cant short"

"This is a dumbest investor. this is the time to buy stocks and sell properties. So you bought property this year .. condemned already"

"SHARES???!!!!!!! DONT BE STUPID LAH. NOW NO COMPANY IS SAFE. NO GUARANTEE COMPANY WONT GO BANKRUPT. BLUE CHIPS LIKE AIG, LEHMAN SHARES ALL DROP TO ZERO AND ALMOST ZERO. YOU ARE DUMP. SHARES CAN GO DOWN EVEN FURTHER. PROPERTY - YES PRICE CAN GO DOWN BUT NOT MUCH. AND I STILL COLLECT RENT!!!!!!!! "

"BE FEARFUL WHEN OTHERS GREEDY (some ppl are still greedy about property) .. BE GREEDY WHEN OTHERS FEARFUL (most ppl are now fearful about stocks, be selective and you will reap handsome profits)"

"property prices will remain strong. stocks very risky.. yes i am surprised even US blue chips can go bankrupt"

"Ya, please help the developers by buying up the properties and be the suckers, property prices will remain strong, yeah right! "

Capitaland 3.750 -0.210

CITYDEV 8.450 -0.410

GuocoLand 1.710 -0.150

Ho Bee 0.585 -0.025

KepLand 3.060 -0.130

SCGlobal 0.600 -0.010

Wing Tai 1.120 -0.030

"shares got shorted down but physical property can't be shorted .. therefore it makes sense for property to be the most superior investment asset - you get to enjoy good rental cashflow without much worry. unlike shares dividends are not guaranteed as company can go bankrupt any time. any fall in property prices in spore (not US as US property prices will remain low for many years) will rebound as spore economy will grow higher with the opening of two mega global IRs "

"short sighted!! property will crash worse than stocks ... just 40% off $1M and you'd lose $400K, $1M then would be enough to buy two properties instead of one ... "

May also want to read:

Warren Buffet Investment Tips

Bill Gross Investment Tip on preserving your capital for the next bull run

Buy or Not Buy: How to decide amid mixed market signals

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

Posted by

Smart Buyer

0

comments

![]()

Property Investment Advice: Property Price always go up in the long term?

Here is an enlightening look at this widely established wisdom:"It is the median property price that will go up steadily with economic growth in the long run. But peak price, not necessarily, cos the subsequent peak/s maybe lower than the previous one .. Plus you have to add your mortgage cost and consider time value of money. E.g. if you bought a property in 1996 peak, the value of your property today is most likely still below the price you bought in 1996 in absolute term. Add your mortgage interest, the actual amt you'd have paid may be double. If you sell it now, it probably fetches about 70% of the price you paid in 1996, but that 70% is worthed still today than 1996 given the high inflation now, that's the time-value of money has declined. So buying at a property peak could see your asset condemned to a life sentence of being a negative asset."

(The graph below shows the private property price index from 1990 -2008, with an "imaginary" graph drawn in red to represent the trend of the median price)

From the graph above,

"You will see that the 2000 peak was below the 1996 peak, so that supports my proposition that peak price may not necessary be higher than the previous one. The 1996 peak is a sharp, anomalous spike. Here's the warning: The current developer's price is well-above this spike. Try drawing a graph for the median price, superimposed on this graph, you'd see that the current price level is destined to moderate. Btw, we are in another financial crisis now. According to economists and bankers, it is the worst in a century. So it's definitely worse than the Asian Financial Crisis. We may only be at the beginning of it. "

Posted by Anonymous at the Singapore Property Forum

May also want to read:

History of Singapore Property 1960 to 2008

HDB Resales Price Index 1990-2008: Graph & Chart

Buy or Not Buy: How to decide amid mixed market signals

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

Posted by

Smart Buyer

0

comments

![]()

Labels: 9. Investing-Buying Property Advice, 9.9 Singapore Property Crash Trends - sept

Singapore Economic Outlook: Non-oil Exports fell 14% in August 2008

Singapore's non-oil exports fell 14% in August year-on-year as slowing global economic growth cut consumer demand for electronic goods. The drop in exports was led by electronic goods which fell 19%. Pharmaceuticals also fell by 9.6%. Exports, however, rose 2.0% compared t0 July 2008. Singapore government cut its 2008 economic growth forecast last month to between 4-5% on expectations of falling consumer demand in the U.S., Europe and Japan. Exports fell 5.8% in July 2008 year-on-year. The continuous decline in August raises the probability of a technical recession in 2008.May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Wednesday, September 17, 2008

Executive Condo Site @ Punggol for sale under Government Land Sales Confirmed List

An Executive Condominium (EC) housing site at Punggol is released for sale under the Government Land Sales Programme's confirmed list with a lease term of 99 years. The tender will close on Tuesday, 11 Nov 2008. The project completion period is ~2 years from the date of acceptance of tender. The site is near the Punggol MRT station, the Cove LRT station and the future Punggol Town Centre. Other amenities within walking distance include schools, shops and neigbourhood parks.Under the new HDB ruling, 90% of the units in a new Executive Condo will be set aside for first-timers during the first month of sales. First-time buyers with a household incomes of up to $10,000 are eligible to apply and are entitled to a $30,000 Housing Grant from the government.

Property consultants expect lukewarm response from developers despite the site’s attractive location. The recent financial crisis in the United States is likely to further dampen sentiment in the Singapore housing market, said Mr Nicholas Mak, director of research and consultancy at Knight Frank, who predicts fewer than five bids. Mr Mak thinks the site can fetch $73 million to $87 million, or $100 to $120 per sq ft (psf) of gross floor area. Finished units could be launched at $500 to $550 psf, based on recent home sales in the area.

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Tuesday, September 16, 2008

Singapore jobless rate rises to 2.3% in June 2008: Real Wages Down as Inflation Soars

Singapore's jobless rate rose to 2.3% in the second quarter after seasonal adjustments, compared to 2% in the first three months, in line with expectations of rising unemployment amid a slowing economy.For the second consecutive quarter, the overall unemployment rate rose from a seasonally adjusted 1.7% in December to 2% in March and further to 2.3% in June.

Construction Industry added most jobs

The construction industry contributed the most jobs of 22100 in Q2 2008, substantially higher than Q1 2008. Outside of construction, employment growth has moderated from the previous quarter. Services added 37600 workers in Q2, down from the gains of 46500 in Q1. Manufacturing sector, the worst performer, posted gains of 10200 in Q2 2008, down from the increase of 11800 in Q1 2008.

Notice from the chart above that job creation is moving away from the manufacturing sector, where Singaporeans are traditionally employed, to the construction sector which does not involve most Singaporeans,

Retrenchment remains at same level year-on-year

After rising for two consecutive quarters, retrenchment eased in the Q2 to about the same level as a year ago. MOM estimates show that 1900 workers were retrenched in the Q2 2008, down from 2274 in the Q1 2008. The manufacturing retrenched 1300 workers and the service industries 600.

Resident Unemployment remains at same level year-on-year

The increase among the resident labour force was from 2.4% in December 2007 to 2.9 per cent in March, and 3.1% in June 2008. The prevailing overall and resident unemployment rates are at the same levels as a year ago in June 2007.

Real Wages Down as Inflation Soars

MOM data also shows that wage increases by 3.1%. But inflation rate was 7.5% in June. So real wage increase - wage increase minus the effect of inflation - actually fell. The services sector was hardest hit, with workers' real wages falling the most, by -4.6%. The manufacturing sector saw -2.3% drop and -0.5% for construction workers.

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Singapore Private Property Sales Down 81% in Aug 2008

Private home sales in Singapore dropped 81% in August from a year ago, to the lowest level since March 2008. Sales of new residential projects, comprising both houses and apartments, fell to 320 units from 1723 units sold in August last year, and sales were also down 64% from the 901 units taken up in July 2008, according URA data.Most property consultants attributed the decline to August being the chinese Hungry Ghost month. However, such argument does not seem to be true during the property booms in the few past years when Singaporeans continued their buying sprees even during the Ghost month. "We can blame the ghosts partly, but I think it's more that all this bad news about global banks is creating a real sense of anxiety among homebuyers," said Colin Tan, Singapore-based head of research for property consultancy Chesterton International. Mr Tan felt that the private property market is basically dead. 'Sales cannot be zero, but at 320 homes sold I would describe the market as dead, there's no two ways about it,' he said.

Worries over Singapore's economic outlook have ended a four-year housing boom in the city-state, as price growth for private homes slowed sharply in the April-June period, rising just 0.2 percent in the quarter. Singapore manufacturing sector has already shown sign of being hit by the global crisis.

Analysts have dropped share price targets for developers such as CapitaLand, Keppel Land

May also want to read:

HDB Upgraders trapped in "Buy High, Sell Low" in the boom-bust of the 90s

History of Singapore Property 1960 to 2008

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

Posted by

Smart Buyer

6

comments

![]()

Labels: 0.5 Property News Analysis Sept 2008, 3. Private Property Outlook

Monday, September 15, 2008

A Home-Buyer and Home-Owner honest view of the private property market outlook

The following forum discussion provides a candid view of the outlook of the Singapore private property market from the perspective of a home buyer who has recently bought his home; and a home-owner who, like many other home-owners, has no intention of selling his home.Home buyer wrote:

Dear Forumers,

Just sharing a reality. I have recently had an offer of $820k accepted for a 999-yr leasehold condo along upper Bukit Timah Road. That works out to be abt $740psf.

The initial asking price for the unit is $795psf. Some of the units are even asking for $850psf and above. Good luck to them.

I actually made 3 offers to different units in the project and all of a sudden, all 3 came back on the same day. I guess the owners must have just received the notification of TOP from the developer and is panicking to get their loans approved.

My point is, prices are slowly, but surely coming down. I would not have committed on the unit if I was not shopping for a home to stay in the vincinity due to vested interest.

I would rather wait till next year.

So dear bulls aka. property agents in this forum, please provide facts when you are trying to push across a message.

Do not flood this forum with contruction costs, MM's vision of the golden years, IR dream, etc.......

The harder one tries to wipe away an ink smudge, the worse it gets.....

Home Owner replied:

It's truely generous of you to tell us your experience and honest view of the market outlook, despite just having bought a unit yourself. I'm a home owner along the same district too and I share your view. To say that property price is moderating is not only being just downright honest but as a home owner with no intention to sell my home, I actually welcome the moderation, rather than see the price get chased up to the sky by speculators and then crash sharply. The only people who will go on talking up the market are the property agents and the desperate hot potatoe sellers which are the so called "bulls" here.

Anonymous wrote:

It's refreshing to hear from you guys. I must say the seller of the Upper Bukit Timah unit is a fortunate fellow in times like this, even thoough he has been quick to seize the scant opportunities in a falling market. Anyway, I have seen expectations drop by 10% in areas like Thomson and Bishan too.

In the end, it all boils down to incomes. It doesn't matter if lots of FT's flood the market but if their incomes don't match, prices cannot be sustained. And FT's are even more averse to taking heavy mortgages.

Posted by anonymous in the Singapore Property Forum

May also want to read:

History of Singapore Property 1960 to 2008

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

Posted by

Smart Buyer

0

comments

![]()

Reality returns to Singapore Property Market 2008

This happened in 1998...will it happen again?Reality returns to Singapore Property Market...

In a market severely distorted by speculation, people buy with over-optimism that their property 'll make money, and less thought is put into whether the property is really worthed that much.

Take for example the enbloc fever. Old HUDC price soared by as much as 80% in a year because people were buying the "enbloc potential". Now that most enbloc potential has vanished, people look at the old and run down HUDC and ask how could it be worthed more than a million.

Now that reality has returned to the market, home buyers will think whether they want to sacrifice so much of their lifestyle just for a roof over their heads. Investors will make their calculations in terms of rental return and the risks of property investment as compared to their other investments.

Displaced enbloc sellers looking for replacement homes may keep the market going for a little longer, but the market will be mostly dominated by rational thinking rather than promises of a rosy dream.

The cooling market has exposed the weaknesses of the many arguments for the continuous climb in property price, like the simplistic view that IRs will bring so many people and therefore so many more housing uints will be needed. People begin to see the reality that it's not just the number of people who will be coming to Singapore but the sort of spending power these people have will eventually determine the sustainable property price.

Posted by Anonymous in the Singapore Property Forum

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

HDB Upgraders: Lessons learnt from the Property Boom-Bust of the 90s

More HDB owners upgrading

My Paper reported on 11 sept 2008 in the article entitled "More HDB owners upgrading: Trend is fuelled by falling prices of private homes in Q2 this year" that HDB upgraders' share of private property bought in Q2 of 2008 has risen to 34% from the 28% in the previous quarter. The report was based on a DTZ's analysis of caveats captured by URA (Urban Redevelopment Authority of Singapore). The data is shown in the Number of Private Property Transactions Chart below:

HDB Upgraders: Lesson Learnt in the Boom-Bust of the 90s

But let's take a harder look at the given data. If you compare Q2 2007 and 2Q2 2008, also quarter on quarter, the numbers were 2,982 and 1,199; a decline of more than 50%. It clearly says that the HDB upgraders are also cooling off the property peak of mid-2007. Under the current economic turmoil, prudent HDB upgraders, I believe, would have preferred to stay put. Some may still remember the lesson learnt in the last Asian financial crisis when HDB upgraders bought into hugely over-priced private properties in the mid 90s peak, counting on the similarly soaring HDB resale price then to pay for their private properties. But came 1998, with Asian Financial Crisis, the property market crashed. These HDB upgraders found themselves trapped in a "buy HIGH, sell LOW" situation.

I remember specifically a friend who was caught in the above situation. In 1996 when he bought an uncompleted private condo at $1.2M, his HDB executive flat was valued at $600+K. But when his condo was completed in 1998 and he had to sell his HDB executive flat, it could only sell for $400+K. What's worse, that year he was retrenched ... (I can say for sure that this is a typical rather than a special case.)

Big Picture: Private Property Sales has declined sharply

As the chart above shows the total purchases of private property has declined sharply from 35,623 in 2007 to 6666 for the first half of this year. So HDB upgraders or otherwise, the number of buyers in the private property market is quickly shrinking. Given the increasing pace of deterioriation in the global economic turmoil which is likely to last to 2009 and possibly even 2010, the Singapore private property market looks set to decline further.May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Labels: 0.5 Property News Analysis Sept 2008, 3. Private Property Outlook

Friday, September 12, 2008

Property Investment Advice: Only Invest with money you can afford to lose

The following forum exchanges is extracted from the Singapore Property Forumanonymous 1 wrote:

to all forumers here

i am concerned of some people who speculate with their home. they sold off their home hoping to buy back later cheaper. this is stupid and dangerous. your home is precious. do not speculate. now many who sold off earlier in 2006 hoping the market to go down are panicking because prices are not falling instead have risen since then. property prices will not go down instead are going up. pls think. dont be stupid.

anonymous 2 wrote:

I agree that it's too speculative to sell your home hoping for a gain but it's equally speculative to say that price will go up and start buying in. The best thing to do is stay put. Don't sell, if you don't have to sell unless you forsee cash flow problem. Don't buy if you don't have to buy because the economic downturn is going to be prolonged and the impact can be severe...

Ann wrote

The problem is that for many of us, we only do own one property, and that property is our home. That's not something you want to gamble with. Don't gamble with what you cannot afford to lose.

If you're a HOME buyer, you may have a stronger reason to commit such a large sum of money. (Even then, timing is important).

But if you're an INVESTOR/speculator, unless you have a SPARE million dollars that YOU CAN AFFORD TO LOSE, then I think don't its wise to play the property GAME, ESPECIALLY AT THIS POINT soon after prices have just shot up 50%-100% in 2 years, are starting to retrace, at the brink of a global recession/slowdown, and with the excesses (sales and building) of 2007 coming onstream in 1-2 yrs.

You can still invest in property via REITs, at a level that you can afford. Don't bet your life, you could lose it.

anonymous 4 wrote:

YES SOME ARE IRRESPONSIBLE ... SELL THEIR HOMES AND THEN APPLY FOR HDB RENTAL FLAT!!!!!!!!!!!!

THESE PEOPLE ARE TAKING AWAY PRECIOUS RESOURCES AND REDUCE THE CHANCES OF PEOPLE WHO ARE REALLY POOR AND DESTITUTE WHO REALLY NEED THE RENTAL FLATS ...

Anonymous 5 wrote:

Good advice. Point taken.

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Economic Outlook 2008: US Exporting Subprime Problem to the World

I may be no expert in economics, but one thing I do know, there is a universal law of conservation of energy.Money can be seen as a surrogate of energy, so the principle of conservation of energy applies to wealth/debt.

US has been using more money than it actually earns (boom). This has been going on for years. But all that debt doesn't disappear. It merely gets hidden. Sooner or later, the equations have to balance (bust).

Because wealth like energy doesn't come from nothing, all that debt cannot just disappear. What the US government is doing now is simply redistributing that debt around, first from the bank to Fannie/Freddie, then the US treasury, then the US dollar, and hence to all who own US dollars, including Asia.

Posted by Ann in the Singapore Property Forum

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Wednesday, September 10, 2008

Singapore Property Market: Is there sufficient government regulation to deter a subprime crisis

Americans have been blaming their government for the subprime crisis and have been calling for greater government regulations in the mortgage market. Recently, the US government has literally been cornered to bailout the two irresponsible giant lenders, Freddie Mac and Fannie Mae.Back here, the Singapore government has repeatedly stated that it'd not bail out any financial institutions. But then again, could the repercussions of any such collapse in the financial sector be so detrimental to our economy that our government may just be cornered into a bailout, just as it has happened to the US government? Are our banks even thinking of that?

There's concern among Singaporeans that the Singapore property market is too laden with debts fuelled by easy credits (the Deferred Payment Scheme, DPS). Undoubtedly, the Singapore goverment has been reputed for its tough stance. Undoubtedly too, the Singapore government has also acted.

In a bid to curb excessive speculation, the Government scrapped the DPS in October 2007. But since then, banks including OCBC and UOB have rolled out similar schemes in the form of the interest absorption scheme (IAS) and the zero-instalment scheme. Under the new schemes, buyers have to sign up for a bank loan for the property. Once the credit worthiness — based on factors including income level, credit history and repayment ability — is established, the buyer pays nothing more until the TOP is issued. Under the IAS, the developer pays the interest to the banks during that period. To this, Chesterton International associate director Colin Tan said: “The question is, how strict are the banks when they assess credit worthiness? The banks in the United States behaved irresponsibly; what is there to stop Singapore banks from behaving the same way?”

If depending on banks' self-regulation is insufficinet to deter a subprime style crisis in Singapore, should there not be more government regulation in this respect? For instance, government could raise the downpayment for property buyers who already own at least one property. This will not only reduce bank liability in the event of a mortgage default, it will also reduce the steep competition that first-time home buyers are facing from investors and especially, speculators out to make quick money out of them.

The current insurance to depositors of $20,000, or even if the insurance is increased to 100% of the deposit as someone has suggested, does not tackle the root of the problem. As we have learned from the US subprime mortgage crisis, insurance may not be of any good when a financial crisis, which originates from the reckless operations of banks, erupts. There should be government regulation to ensure that banks here are indeed lending in a responsible manner. Lenders must be required to meet the highest standard of ethical code with regard to protecting the money of their depositors.

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

4

comments

![]()

Tuesday, September 9, 2008

Singapore Property Market laden with too much debt

Property is "bad" space for investment because there is a lot of debt in it - built up from Deferred Payment Scheme, speculation and low interest rates.Posted in the Singapore Property Forum

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Singapore Economic Outlook: Manpower Employment Outlook Survey shows hiring to slow in Q4 2008

Singapore Manpower Employment Outlook Survey shows hiring to slow in fourth quarter of 2008..

The sectors that will be least affected by the slowdown are expected to be teaching posts and jobs for public administrators, according to the latest Manpower Employment Outlook Survey.

.

There will still be some hiring in the fourth quarter, with the overall net employment outlook standing at 25%, according to research company Manpower Staffing Services.

Net employment outlook measures the percentage of employers expecting to increase the number of people working for them, less the percentage expecting to employ fewer people.

The outlook has “weakened considerably” — 33% points down on the comparable period last year — showing that the economic downturn is affecting employers’ hiring confidence.

“Companies will be very cautious when making hiring decisions and are paying more attention on their staff productivity figures,” said Mr Philippe Capsie, country manager of Manpower Singapore. “We have to be prepared for more job losses, mainly in the manufacturing sector, if the slowdown continues.”

Employers in the transportation and utilities sector are the most pessimistic, with an outlook that declined by 51 percentage points quarter-on-quarter.

Mr Kwan Chee Wei, group chief human resources officer of supply chain company IMC Corp, said: “We did the bulk of hiring in the first half and are likely to slow down for the rest of the year. This has nothing to do with the external slowdown. Nevertheless, we are always on the lookout for talent forfuture expansion.”

The strongest employment projections came in the services and construction sector with 25% of employers expecting to take on people, followed by the public administration and education sector with 22%.

The former is likely a result of the upcoming projects such as F1 and the integrated resorts, said Mr Capsie. “Services and construction sectors are likely to continue hiring to meet the high labour demands required of these industries,” he said.

Overall, 26% of the 629 employers surveyed expected to hire more people in the final quarter of this year, while 44% did not foresee changes in hiring, and 10% may reduce staffing.

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Economic Outlook 2008: US Government's Takeover of Fannie-Freddie does not end subprime problem

On 7 Sept 2008, the US Federal Government announced its takeover of collapsing mortgage firms Fannie Mae and Freddie Mac, the two largest US home-loan lenders. The stock markets all over the world rallied on 8 Sept 2008, interpreting the "takeover" as an indication that the United States government will do whatever it takes to prevent the global credit crisis from deepening. While stock indices jumped 3%-5% all over the world, analysts cautioned that this was just a bear-rally that would at best extend for a few days. The fundamentals haven't changed: US Subprime problem will persist as long as mortgage payment remains a problem and continues to be worsened by increasing US unemployment rate which has surged to 6.1%. The "takeover" will not lead to an immediate improvement in employment and pumping money into these mortgage institutions will not encourage Americans to come out and buy homes.The following are some views of forumers extracted from the Singapore Property Forum:

ann wrote:

Subprime borrower transfers his debt to the bank.

Bank runs into trouble and passes debt to Fannie/Freddie.

Fannie/Freddie runs into trouble and now transfers liability to the US Treasury.

But who backs up the US Treasury? Nothing comes from nothing. Someone eventually pays the price. US taxpayers, and all the foreign governments holding US Treasury bonds.

But investors don't want to take on bad debts and lose money.

Just as investors first fleed the subprime borrower, then the banks, then Freddie/Fannie, now, it will be the US dollar itself that is subprime and governments will flee the devaluing dollar .

US is passing on its bad debt to the world. We will be affected.

Anonymous 1 wrote:

The US is getting into a deeper and deeper shit this time round.

Anonymous 2 wrote:

The US is going to suffer Big Time, just like those who bought and cannot offload their condo.....Big Time..

Anonymous 3 wrote:

Let's just wait and see the outcome.............it will be interesting I agree with your view.

Anonymous 4 wrote:

I agree with the view expressed.

Yesterday stock market rally is not going to last .. it's stupid to be a part of it.

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

2

comments

![]()

Singapore Property Investment: Capitaland's risk of residential sites bought in 2007 peak price

Citigroup cuts Capitaland's target price from $5.47 to $3.90 based on a 20% discount from net asset value, citing the risk of Capitaland having to make provisions for its Singapore residential sites, several of which were bought during the property peak price of 2007.Capitaland has also sold several of its assets in China and Malaysia recently. At the end of Aug 2008, Capitaland has sold 30% stake in Invergin whose principal asset is a 50-story building in Kuala Lumpur. Last week, Capitaland sold its Chinese Office property, Capitaland Tower in Bejing.

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Related article:

Brokers' Take - Business Time: Brokers' Take - 06 Sep 2008

Posted by

Smart Buyer

0

comments

![]()

Monday, September 8, 2008

Analysts divided over "2010 Singapore Property Crash Scenario"

Last month Wing Tai Holdings’ chairman Mr Cheng Wai Keung, known for his candid assessments of the property market, warned that the peak prices in 2006-2007 could lead to a property crash in 2010 when these projects obtain their TOPs. Only a spectacular economic recovery would stop the property market from being flooded with these “expensive apartments”, according to Mr Cheng.Analysts, however, are divided over the likelihood of such a property crash coming about in 2010.

Chesterton International associate director Colin Tan pointed out that apart from the global economic uncertainty and financial market turmoil that has hurt demand, the situation is made worse by the fact that developers, buoyed by the property fever during the property boom in the last couple of years, now have “too many projects on their hands”. Adding to this, the buzz surrounding the F1 Grand Prix and the integrated resorts was “overplayed”, leading to “unrealistic” prime district property prices. Mr Tan added: “We know the market is declining, but yet, developers are still launching their properties.”

Standing out against the doomsayers, Wakefield and Cushman managing director Mr Donald Han said that the market is “still flushed with cash”. He said: “If you look at Singapore’s wealth management industry, it’s still growing. Any investors looking to put his money into Asia will first take into consideration political stability and economic growth.”

Dr Chua Yang Liang, head of South-east Asia research at Jones Lang LaSalle, felt it was “difficult to call”, adding that the construction crunch has slowed the pipeline, mitigating fears of an oversupply of private homes. Dr Chua said: “Looking at it on face value, yes, there’s a potential (it could happen). For those who bought the properties under the deferred payment scheme (DPS), they may have overstretched themselves. But nobody knows the financial background of these buyers.”

In a bid to curb excessive speculation, the Government scrapped the DPS last October. But since then, banks including OCBC and UOB have rolled out similar schemes in the form of the interest absorption scheme (IAS) and the zero-instalment scheme. Under the new schemes, buyers have to sign up for a bank loan for the property. Once the credit worthiness — based on factors including income level, credit history and repayment ability — is established, the buyer pays nothing more until the TOP is issued. Under the IAS, the developer pays the interest to the banks during that period.

Dr Chua noted that compared to the DPS, the new schemes allow banks to carry out more extensive checks on the prospective buyers before extending the loans. But some fear a replay of the United States sub-prime woes, sparked by mounting defaulted payments. Mr Tan said: “The question is, how strict are the banks when they assess credit worthiness? The banks in the United States behaved irresponsibly; what is there to stop Singapore banks from behaving the same way?”

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

2

comments

![]()

Sunday, September 7, 2008

Home Buying Advice: Bargain Hunting, Checklist, Home Loan Shopping, Selecting a Conveyancing Lawyer & Mortgage Insurance

Just in case you've missed the article entitled "Looking for your first home?" from Sunday Times - 7 Sep 2008, it has got some really helpful home buying tips that you should read. Here's the article with my comments in bold:Bargain Hunting in a quiet market maybe a good idea but don't assume you're going to get a bargain

While there is little to be excited about in today’s quiet property market, it may be a good time for genuine home buyers to take advantage of the slowdown and scour the market for bargains.

Now that the inauspicious Hungry Ghost month has passed, developers are gearing up to launch new projects and home sellers may also start to test the waters again.

If you are a first-time home buyer, what should you know before taking the plunge?

(Refer to Checklist for Buying Property)

Of course, there are the obvious pointers: set a budget, select a few locations you prefer and consider how much space you will need.

Then there are some other considerations that new buyers may not be aware of, said Mr Dennis Ng, spokesman for mortgage consultancy portal HousingLoanSG.com.

Home Loan Shopping before Home Hunting is prudent, especially during uncertain time like this

For instance, he recommends shopping for a home loan before shopping for the home itself. Obtaining an in-principle loan approval from a bank allows you to calculate the exact loan amount you can get based on your income and repayment ability.

Mr Dennis Khoo, Standard Chartered Bank’s general manager of lending, said: ‘Quite often, customers can get a larger loan than they were expecting, so they can then look for a larger home.’

Do Your Homework, Don't Just Depend on Property Agents

The big search

Once that’s over and done with, you can start house-hunting in earnest.

New buyers often ask if property agents are really needed. While they can be a big help in the initial browsing stage, it is essential to know just as much as - if not more than - your agent to avoid being short- changed.

First, find out what potential buys are out there by combing the classified ads for a few weeks. You should soon be able to identify price trends and properties that have been on the market for some time, which might be more open to negotiation.

Diversify into online property listings, like ST701 (st701.com) and the Singapore Land Authority’s Nation Property portal (nationproperty.sg). They often come with pictures, floor plans and location maps, which give valuable information on a particular project.

On top of that, do your homework by checking out recent transactions in the development you are interested in. This will give you an idea of market prices and better bargaining ability.

You can find recent deals for private property online at the Urban Redevelopment Authority’s website (www.ura.gov.sg). For HDB resale flats, check the HDB website (www.hdb.gov.sg).

Mr Ng also advises new buyers to view houses at different times of the day to gauge noise levels and sun exposure that might change throughout the day.

Selecting Your Conveyanciny Lawyer: Get Recommendations from Trusted Parties

The big buy

When you finally locate your dream home, what do you have to do to secure it?

The bank you plan to take a loan with will arrange for a valuation report of the property and offer the services of lawyers it might have links with. If you find your own lawyer, note that not all lawyers are approved by banks and this may result in additional legal fees, said Mr Ng.

He added that legal fees are typically about $2,000 for HDB flat purchases and $3,000 or more for private property.

Also, it is important to make sure that your lawyer can act for the Central Provident Fund (CPF) Board as well as the bank if you are planning to use your CPF funds for the property purchase, said OCBC Bank’s head of consumer secured lending, Mr Gregory Chan.

‘Not only is it more convenient, but you also save a bundle on legal costs,’ he added.

Mortage Insurance: Give your loved ones the peace of mind

Another consideration is mortgage insurance, which covers the home loan balance in the event that the borrower dies or is totally and permanently disabled.

‘Because life has its uncertainties, it is our practice to recommend all OCBC home loan customers to protect their liability by taking up mortgage insurance,’ Mr Chan said.

‘We typically recommend that the borrower insures his or her full loan amount to ensure adequate coverage.’

May also want to read:

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

When to Buy, When Not to by

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Posted by

Smart Buyer

0

comments

![]()

Thursday, September 4, 2008

Jurong East Lake District Transformation could translate into High Resale Property Prices for Jurong East, Bukit Batok, Clementi and Jurong West

Todayonline reported that the Jurong East Lake District transformation could translate into high resale prices for properties in Jurong East and the neighbouring towns including Bukit Batok, Clementi and Jurong WestJurong East has always been viewed as a rather lacklustre "ulu" estate with just over 22,000 homes. Even neighbouring Bukit Batok and Clementi have over 32,000 and 24,000 homes respectively.

However, in April, National Development Minister Mah Bow Tan unveiled in its masterplan to transform Jurong East into the new Jurong Lake District which is sited to be the largest commercial hub outside the Central Business District.

Chief executive of Propnex, Mohd Ismail, said that he expects to see, in the initial stages, a marginal 5-10% price increase in the properties in Juorng East. However, upon completion of the many facilities and amenities, and as more businesses gradually shift their operations to the new Jurong Gateway precinct, we should even be able to see price increases of 30% to 50%.

As a comparison: For the first quarter of the year, the median resale prices for five-room HDB flats in Bukit Merah and Toa Payoh — estates that are considerably close to town — were $585,000 and $538,000 respectively, while the median resale price for a five-room HDB flat in Jurong East was just $386,000.

We can also expect to see a spillover effect from the revamped Jurong Lake District in the surrounding hinterland towns of Bukit Batok, Clementi and Jurong West.

Mr Mohd Ismail strongly encourages Jurong East residents to hold on to their properties due to the strong prospects for a high resale price upon completion and establishment of the Jurong Lake District.

May also want to read:

HDB Resales: West Sees Highest Price Increase

Jurong East Lake District Good Property Investment Prospect

History of Singapore Property 1960 to 2008

Buy or Not Buy: How to decide amid mixed market signals

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

Posted by

Smart Buyer

0

comments

![]()

Labels: 0.5 Property News Analysis Sept 2008, 4. HDB Market Outlook