Saturday, September 20, 2008

About this Blog

Would like to seek your views regarding mortgage loans. Generally is it usually a good idea to stretch a home loan as long as possible?

Recently i was also offered a 3-month sibor package where the monthly installments are fixed, but the principal paid varies with the interest rate.

I think it sounds like a good package as there is some certainty in the amt of monthly installments paid, but any potential pitfalls from this? And the equity accumulation is quite slow due to the length of loan.

Reply by Mortgage Consultant, Mr Paul Ho:

To answer your first question. It is important to understand whether you treat the property as a single home or investment property. Different people may react differently as it is an emotional decision. For some it is an affordability issue, therefore stretching the home loan will allow you to stretch your budget to buy the home of your dreams.

Financially speaking if you are staying in the home, stretching the home loan incurs higher total cost. But some investors have been known to stretch the home loan for as long as possible to maximize their return on invested capital (If this is your concern, I can elaborate more). Longer term loans tend to be costly because all loans are structured in such a way that mostly interests are paid during the earlier years. So you will see that your outstanding loan amount seems to be standing still. Instead of 30 years, some people may take a loan of 20 years and at the end of every 2 years, they take another 20 years loan, to speed up repayment of the principle and reduce overall interest cost.

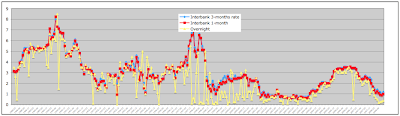

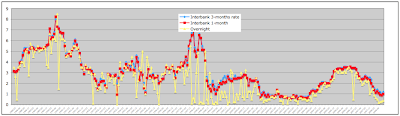

3-Months Sibor with Fixed repayment structured so that the interests are variable and re-priced every 3 months, but you have some peace of mind such that you don't have to worry about how much to pay. Over a 20 year period, interbank rates (Sibor) Singapore dollar Sibor has ever reached about 9% in around 1990. If you are paying Sibor + 0.9%, that would mean you are paying almost 10% interests. Fed overnight rates has gone as high as 20% during the recent financial crisis in which banks stop lending to each other or tightened drastically. So markets such as the Libor (London), Sibor (Singapore) are technically not immune to fluctuations in the market. And as a rule of thumb, a 3-months Sibor fluctuates more than a 6-months Sibor

There are of course potential pitfalls such as lock-in periods. If no lock-in period is concerned, then you are largely open to interest rates shocks (if any). Though Singapore market is generally flushed with liquidity and hence there tends to be a correlation between low GDP and low interest rates, but that cannot be taken for granted.

There is likelihood that interest rates may stay low (same as 2002 to 2005), but this time, there is some marked differences, the M1 money supply is much higher. There is also some risks that US bail-out of private enterprises and banks to the tune of almost 1 trillion (1000 Billion USD), plus US deficit of over 500 Billion, the USA cannot afford to find that money. If they expand money supply (aka print more money) there may be elevated inflation risks and therefore interest rate hikes possibilities. Right now, it's anybody's guess.

May also want to read:

History of Singapore Property 1960 to 2008

Property Investment is best long term investment?

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Mortgage Advice: Is it good to stretch home loan for a longer period to increase leveraging?

Question from a blog visitor:Would like to seek your views regarding mortgage loans. Generally is it usually a good idea to stretch a home loan as long as possible?

Recently i was also offered a 3-month sibor package where the monthly installments are fixed, but the principal paid varies with the interest rate.

I think it sounds like a good package as there is some certainty in the amt of monthly installments paid, but any potential pitfalls from this? And the equity accumulation is quite slow due to the length of loan.

Reply by Mortgage Consultant, Mr Paul Ho:

To answer your first question. It is important to understand whether you treat the property as a single home or investment property. Different people may react differently as it is an emotional decision. For some it is an affordability issue, therefore stretching the home loan will allow you to stretch your budget to buy the home of your dreams.

Financially speaking if you are staying in the home, stretching the home loan incurs higher total cost. But some investors have been known to stretch the home loan for as long as possible to maximize their return on invested capital (If this is your concern, I can elaborate more). Longer term loans tend to be costly because all loans are structured in such a way that mostly interests are paid during the earlier years. So you will see that your outstanding loan amount seems to be standing still. Instead of 30 years, some people may take a loan of 20 years and at the end of every 2 years, they take another 20 years loan, to speed up repayment of the principle and reduce overall interest cost.

3-Months Sibor with Fixed repayment structured so that the interests are variable and re-priced every 3 months, but you have some peace of mind such that you don't have to worry about how much to pay. Over a 20 year period, interbank rates (Sibor) Singapore dollar Sibor has ever reached about 9% in around 1990. If you are paying Sibor + 0.9%, that would mean you are paying almost 10% interests. Fed overnight rates has gone as high as 20% during the recent financial crisis in which banks stop lending to each other or tightened drastically. So markets such as the Libor (London), Sibor (Singapore) are technically not immune to fluctuations in the market. And as a rule of thumb, a 3-months Sibor fluctuates more than a 6-months Sibor

Pitfalls of Home Loans with No Lock-in Period: Interest Rates Shocks

There are of course potential pitfalls such as lock-in periods. If no lock-in period is concerned, then you are largely open to interest rates shocks (if any). Though Singapore market is generally flushed with liquidity and hence there tends to be a correlation between low GDP and low interest rates, but that cannot be taken for granted.

Where is Interest Rates headed?

There is likelihood that interest rates may stay low (same as 2002 to 2005), but this time, there is some marked differences, the M1 money supply is much higher. There is also some risks that US bail-out of private enterprises and banks to the tune of almost 1 trillion (1000 Billion USD), plus US deficit of over 500 Billion, the USA cannot afford to find that money. If they expand money supply (aka print more money) there may be elevated inflation risks and therefore interest rate hikes possibilities. Right now, it's anybody's guess.

May also want to read:

History of Singapore Property 1960 to 2008

Property Investment is best long term investment?

Property Price Index Graph Plotter & Online Property Valuation

Your Property Investment Determines Your Financial Success in Your Life

HDB Resales: West Sees Highest Price Increase

Labels: 5. Mortgage Rate : Home Loans

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment

Dear visitors:

Your comments are most welcome!

The blogger here has been affectionately named by close allies as "Smart Buyer" but really, he's not smart. Smart Buyer just believes that being prudent is smart. That's the essence of the message of this blog and Smart Buyer hopes it'll benefit other property buyers.

Smart Buyer :)